Contents:

If your 501c3 meaning involves selling physical products, QuickBooks can assist you in managing your inventory. This includes keeping track of stock levels, setting reorder points, and generating purchase orders. QuickBooks can also help you calculate the cost of goods sold and inventory valuation. The features and settings that you choose in this lesson will affect every area of QuickBooks. For example, you will set the default payment terms for customer invoices and vendor bills.

Please note that this workshop is only training on QuickBooks Online and not QuickBooks Desktop. If you are being sponsored by your company, click Ok to continue to register. If you have high-speed internet and a computer you can likely take this class from your home or office. Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor, and CPA with 25 years of experience. He brings his expertise to Fit Small Business’s accounting content. This easy-to-use approach includes fully automated project grading with instant, detailed feedback for students.

How To Win Clients And Influence Markets with XERO ACCOUNTING SOFTWARE?

The various ECE web sites link to Internet sites and services outside the administrative domain. ECE does not govern the privacy practices of these external sites. Users should read the privacy statements at these sites to determine their practices.

QuickBooks is accounting software that you can link with your bank and credit card accounts to track and analyze the flow of money through your business. QuickBooks helps you take care of painstaking data entry while also providing accurate and up-to-date books. Finally, QuickBooks can generate various reports to aid in managing your business, including profit and loss statements, balance sheets, and cash flow statements. QuickBooks also has built-in reports that are industry-specific, such as retail and wholesale. You will also learn how to apply payments received to outstanding invoices so that your accounts receivable (A/R) is up to date and income is not counted twice. After this lesson, learn about A/R aging reports, which will help you manage unpaid invoices.

Session Time-Out

Don’t be intimidated by the size of the tutorial―take one lesson or tutorial at a time. First, you can write and print checks directly from QuickBooks to pay for expenses that require immediate payment. Second, you will be able to manage what you owe to vendors by entering and tracking bills. You will learn to enter the payment of these bills correctly so that the expense is not recorded twice.

Each QuickBooks tutorial includes a video where we demonstrate the concepts presented in each lesson. You can also customize your inventory reports and track costs for products and inventory. The flow of business finances is easily the most important data set for a company. Regardless of your organization’s industry or niche, turning a profit is essential to successful operations. There are many people who believe this or that accounting software is good for their business but be… Running an Efficient Business by Accounting on Xero You may use Xero, an online accounting software…

What are the five basic functions of QuickBooks?

In Online (Self-paced) courses, students consume the course material at their own pace. There are no live sessions, and an instructor will not be guiding their completion. Which is the most convenient accounting tool for a small business? Ask questions, get answers, and join our large community of QuickBooks users.

Our course starts with setting up QuickBooks Online for your business. We cover how to record your income and expenses, how to manage bank and credit card transactions, how to manage payroll, and how to run financial statements. There are 46 tutorials in our QuickBooks Online tutorial, spanning eight lessons.

Best QuickBooks Payroll Alternatives for 2023 – TechRepublic

Best QuickBooks Payroll Alternatives for 2023.

Posted: Mon, 19 Dec 2022 08:00:00 GMT [source]

Come April, just print your statements and give them to your tax accountant. Or, with QuickBooks Online, your accountant at your trusted small business accounting services firm can log in and retrieve financial data for your return. You will be able to manage all of your downloaded banking transactions by the end of this lesson.

This textbook moves more slowly and covers fewer topics than a textbook designed for accounting majors. Log in to request an estimate, purchase, and manage your account. ECE may change our Privacy Policy at any time by posting revisions on the Web site. By accessing or using our Web site, you agree to be bound by all the terms and conditions of our Privacy Policy as posted on the Web site at the time of your access or use. If you do not agree to the terms of this Privacy Policy or any revised statement, please exit the site immediately.

Welcome to the Fit Small Business free QuickBooks Online tutorials. Whether you are new to QuickBooks Online or could use a better understanding of the program, these tutorials are designed for you. Each QuickBooks tutorial provides an in-depth lesson complete with text, examples, and a comprehensive video demonstration. Students see the entire process before proceeding through accounting cycle. An introductory accounting cycle image is used throughout the textbook to orient students to where they are at any given time. QuickBooks learns from your interactions to automate categorization for expenses.

FreshBooks vs QuickBooks Online: Which Accounting Solution Is Best for Your Business? – TechRepublic

FreshBooks vs QuickBooks Online: Which Accounting Solution Is Best for Your Business?.

Posted: Wed, 19 Apr 2023 18:46:00 GMT [source]

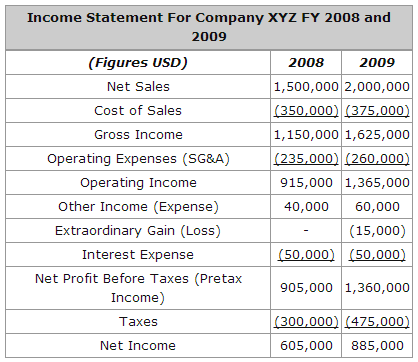

Basically, these heads are categorized as per the function and purpose it serves.

By the end of this lesson, you will be able to manage credit card sales with either a QuickBooks Payments account integrated with QuickBooks or a third-party credit card processor. You should consider accepting credit card payments as a convenience for your customers and to increase the speed that you collect outstanding invoices. Tax time is often chaotic, but it’s easier when you keep accurate records throughout the year in QuickBooks.

ACCOUNTING BASICS TRAINING

For example, let’s say that Electronics Wholesale Inc. purchases 100 laptops at $500 each. Suppose Electronics Wholesale Inc. buys electronic items worth $10,000 from a supplier in China. The company can record this transaction in QuickBooks by creating a new bill and inputting the details, including the amount, date, and account to be charged. This QuickBooks Beyond the Basics course teaches the advanced features and functionality of Intuit’s 2021 desktop software application. Participants will need to have access to a personal computer outside of classroom hours to complete the project. The project will demonstrate the applicant’s ability to successfully implement and maintain a computerised system for a small business using QuickBooks software.

When you have consolidated employee details, it enables you to ensure timely payment to employees. It automatically calculates and runs payroll automatically when you need it. When you enter employee time, these hours automatically flow to invoices and payroll modules. The intended audience is someone who is considering utilizing QuickBooks for their business.

The 29 Best Banks for Small Business Owners in 2023 – Architectural Digest

The 29 Best Banks for Small Business Owners in 2023.

Posted: Wed, 08 Feb 2023 08:00:00 GMT [source]

The platform also manages your accounts payable when you input upcoming bills. You can pay online through bank transfer or check directly with just a few clicks and pay multiple bills at one go. You can also make payments to the supplier via credit cards in QBs. QuickBooks Software Online Bill Pay comes integrated with QBs Essential, Plus, and Advanced. Success comes from keeping good records and using them as planning tools in your business.

- Includes coverage of basic accounting concepts, GAAP, and the full accounting cycle.

- As a small business owner or manager, you know that managing expenses is as important as generating sales.

- If you’re ready to purchase the product, Quickbooks Online is offering new customers 50% off for three months or a 30-day free trial.

- Bookkeeping is much easier when cash transactions are kept to a minimum.

- We’ll get you caught up on how small business accounting services like us take advantage of the power of QuickBooks—and how you can too.

You should plan at least two hours to complete the first lesson, which includes 15 video tutorials. QuickBooks® Online Basics is an introductory-level course designed to build a foundation of essential skills in QuickBooks® Online. In this course, learners will develop a greater understanding of the basic bookkeeping and accounting functions that the software enables. In this course, you will develop a greater understanding of the basic bookkeeping and accounting functions that the software enables. In this lesson, you will learn how to set up key areas of QuickBooks like bank and credit card accounts, invoice templates, products and services, and the chart of accounts. By the time you complete this QuickBooks online tutorial, you will be ready to start using QuickBooks to manage all of your income and expenses.